2025 brings some notable changes to local taxes in Washington State.

Capital Gains Tax

The Washington capital gains tax has been in place for a few years now. Washington taxpayers are subject to a 7% tax on long-term capital gains that exceed an annual threshold (currently $270,000). An additional 2.9% tax is now being added for taxable gains above $1 million. This retroactively applies to any gains realized as of January 1, 2025.

With the annual exemption, this essentially means you must have long-term capital gains of $1,270,000 before the additional tax applies. The first $270,000 is still exempt, and gains from $270,000 – $1,270,000 are still taxed at 7%. Only the gains exceeding this amount are taxed at 9.9%.

There are no changes to the existing exemptions and deductions, such as gains on real estate, retirement accounts, and qualified family-owned small businesses.

Estate Tax

Many are aware of the increased federal estate tax exemption. When someone dies, they can leave assets to their heirs without paying any estate tax as long as the estate is under $13.99 million (or $27.98 for a married couple). This effectively means that very few people need to worry about the federal estate tax. (Note that this is currently scheduled to sharply decrease next year, although legislation is currently in the works that could extend it).

However, many states also have a state estate tax, including Washington. The state exemption is currently much lower, at $2.193 million and has been unchanged for several years. It will increase to $3 million on July 1, 2025, and it will be indexed to inflation each subsequent year. Note that unlike the federal exemption, this is not “portable” between spouses, meaning you cannot double the exemption to get $6 million per couple. When the first spouse dies, everything can pass to the surviving spouse tax free. But when the second spouse dies, they will only be entitled to a $3 million exemption, the same as someone who was never married.

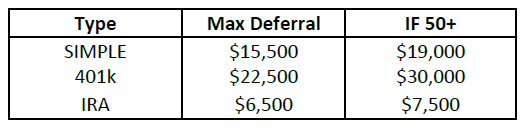

While the increased exemption will allow more people in the state to avoid the state estate tax, once you are above that exemption, the rate at which you pay the estate tax is increasing. Similar to the federal income tax, the state uses progressive brackets where larger estates pay a larger percentage in taxes. The rates currently range from 10%-20%, but the top bracket will now increase to 35%.

|

Taxable Estate (amount above exemption) |

Current Rates |

Rate as of 7/1/25 |

|

<$1m |

10% |

10% |

|

$1m – $2m |

14% |

15% |

|

$2m – $3m |

15% |

17% |

|

$3m – $4m |

16% |

19% |

|

$4m – $6m |

18% |

23% |

|

$6m – $7m |

19% |

26% |

|

$7m – $9m |

19.5% |

30% |

|

>$9m |

20% |

35% |

Business owners can also take advantage of another exclusion, if the value of the business owned makes up over 50% of the taxable estate and has been actively operated by the decedent or a family member for at least five of the previous eight years. Currently, you can exclude $2.5 million of the business from your total estate value. That amount is increasing to $3 million.

However, if the business is later sold, or the business no longer qualifies within three years of death, the State can go back and assess tax on the business as if it had been included in the taxable estate.

Should you have any questions on these tax changes, or how you can best plan to limit your exposure, please do not hesitate to reach out to us.