Author: Kevin J. Bray, Partner @ The Dental Accounting Group

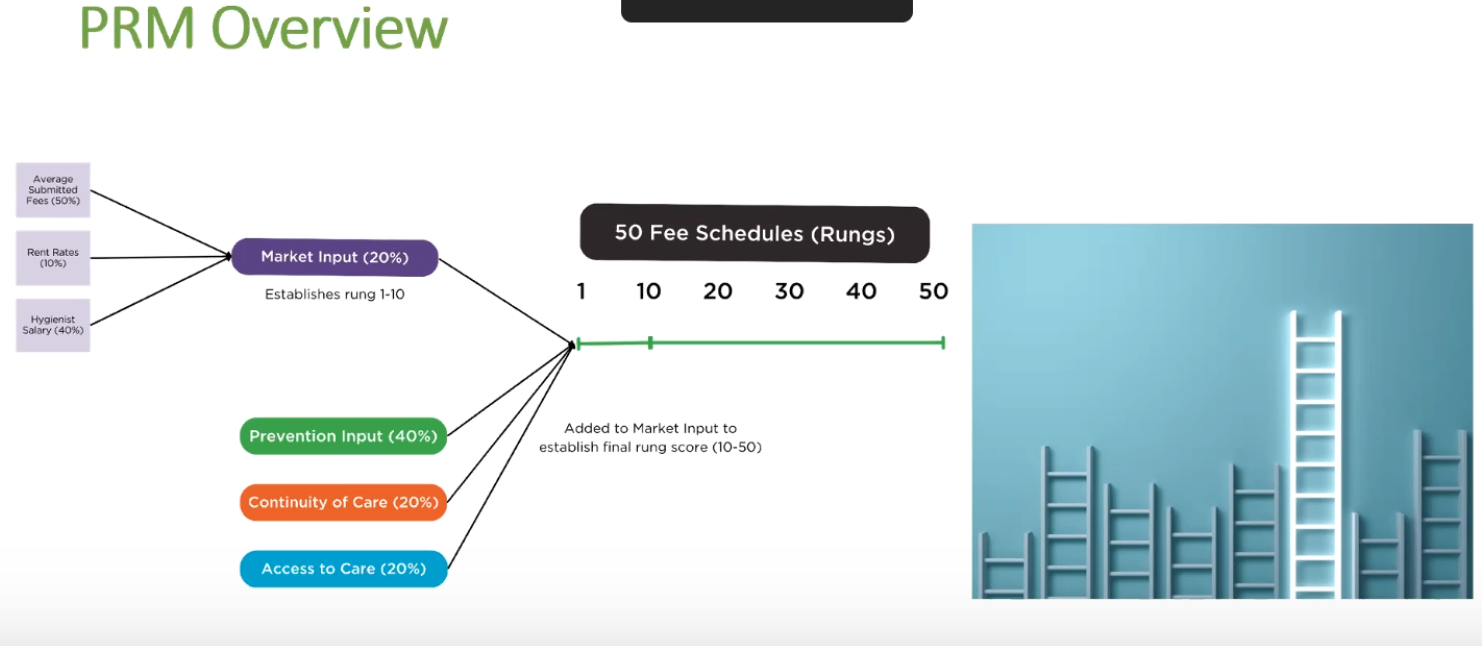

Starting in 2020, Washington Delta Dental (DDWA) introduced pivotal changes to its Provider Reimbursement Model (PRM), designed to address the economic challenges and feedback from dental care providers across the state. This collaborative approach has culminated in a revised system that’s attempting to meet the economic and clinical demands of tomorrow.

As we head into 2024, Washington Delta Dental (DDWA) will introduce another update to their Provider Reimbursement Model (PRM), promising to help the financial underpinning of dental practices. But the question on every practitioner’s mind is straightforward: are these adjustments a beacon of progress or merely a drop in the ocean of economic necessity?

Credit: Delta Dental of Washington

The Promise of Progress

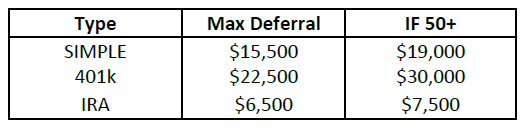

DDWA has pledged a significant investment in reimbursement enhancements, with an estimated $100M earmarked for provider compensation. Additionally, the model now promises to bring about “an increase to your rung score” for 60% of practices on the PRM, ensuring no decreases in fees from the previous year.

The revised PRM marks a significant departure from the status quo, responding to practitioner feedback with a series of strategic enhancements. The highlight is a 5% increase in select hygiene codes, projected to deliver an “overall average annual increase of approximately $5K for each eligible practice.” This is complemented by a shift from a 10-year to a 2-year look-back period for Continuity of Care metrics, reflecting a pragmatic approach to measuring practice performance. Furthermore, DDWA has taken a commendable step towards equity by integrating the “Ultra-Rural” market type into the PRM, aiming to level the playing field for practices across diverse geographic locales.

Credit: Delta Dental of Washington

The Economic Realities

Despite DDWA’s proactive stance, the adequacy of the 5% increase is under intense scrutiny. With overhead costs skyrocketing and hygienist wages in metropolitan areas like Seattle nearing $75 per hour, the incremental raise falls short of what is needed to navigate the economic currents of 2024 and beyond. The hygiene department is not only central to patient care but also to the financial health of a practice. As such, practice owners are advocating for further increases in hygiene reimbursements. This would enable them to pay competitive market wages to hygienists, maintain the quality of patient care, and ensure the profitability of their hygiene department. The delicate balance between fair compensation and operational sustainability is critical. Without additional adjustments to the reimbursement model that account for the steep rise in labor costs, particularly in metropolitan areas, practice owners may find it increasingly difficult to manage profitability while upholding the highest standards of patient care. The adjustment, although a positive acknowledgment, does not fully mitigate the escalating expenses in supplies, services, utilities, and equipment that are outstripping general inflation rates. Therefore, a call to action is clear: future iterations of the PRM must consider more substantial increases in reimbursements to ensure the vitality and success of dental practices.

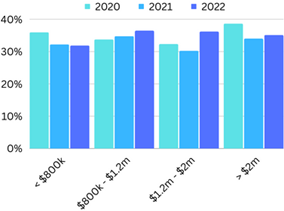

2023 DAG Client Survey Staffing Cost %

© 2023 DG Accounting Professionals LLC.

Staffing costs continue to grow in real dollars and eat up a greater portion of the overall overhead. Many practices are watching total staff costs rise to nearly 40% of their revenue as staff wages increase and revenue remains stagnant.

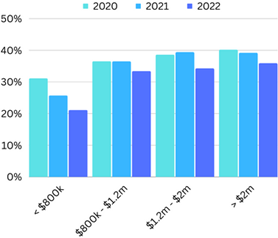

2023 DAG Client Survey Profit Margin %

© 2023 DG Accounting Professionals LLC.

Profit margins before associate pay have dropped in recent years mainly due to wage inflation and other rising costs of doing business in urban metropolitan areas. Practices across the board saw roughly a -5% decline in profits YOY.

A Tale of Two Practices

The disparity between urban and rural practices remains a critical subplot in this narrative. While the new model intends to harmonize this imbalance, rural practices continue to navigate unique challenges that a universal model might not fully address. Meanwhile, urban practices grapple with a competitive job market and elevated living costs. The “Ultra-Rural” adjustment, although well-intentioned, could still leave certain practices grappling with financial sustainability. The implications of these changes are far-reaching. Dental practices across Washington can anticipate a more equitable reimbursement scenario. By integrating “ultra-rural” market type and adjusting targets to the 95th percentile per market, DDWA aims for a fair comparison among peers, fostering a level playing field for all practices, irrespective of their size or location.

New Ultra Rural Market Types Added:

Credit: Delta Dental of Washington

Summary of Key Modifications Taking Effect

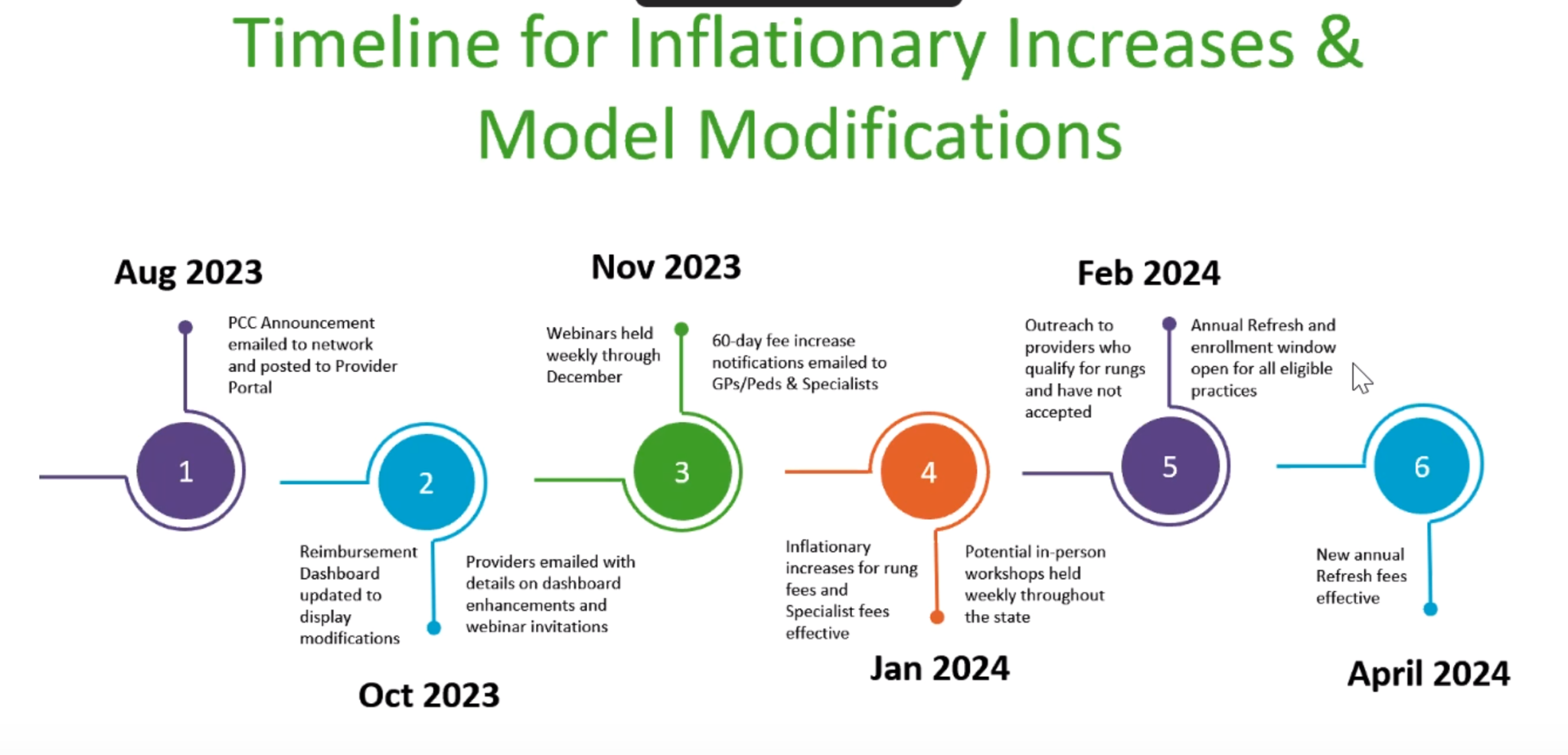

In the spirit of transparency and to aid providers in understanding the impending modifications, DDWA has offered a detailed glimpse into the changes:

- Inflationary Adjustments: A 5% increase on select hygiene codes for participating providers will be instituted. This adjustment is a strategic move to counteract inflationary pressures but falls short of the needs of the average practice. The overall average annual increase is only approximately $5K for each eligible practice. This is hardly an “inflationary adjustment” considering wage inflation alone for full-time hygienists has increased on average 15% during the last two years.

- Simplified Metrics & Feedback-Driven Revisions: The PRM will adopt simplified metrics for assessing practice performance. For instance, the retention metric has been revamped to a “Continuity of Care” standard, focusing on a 2-year look-back period, down from the previous 10-year span, to better align with practice realities.

- Expansion of Eligibility: With the PRM modifications, a significant “68% of practices on the PRM will experience a score increase and an additional average annual projected increase of ~$9K per practice”.

- Fee Schedule Updates: Providers will see their new fee schedules on the Provider Portal, which will automatically reflect the changes for 2024.

- Inclusive Model Adjustments: Modifications will affect all four inputs—practice costs, prevention, access, and retention—streamlining the metrics for better clarity and ease of management.

- Prevention-Centric Increases: There is a special focus on preventive procedures, with a 5% inflationary increase on codes such as D1110 (adult cleaning) and D1120 (child cleaning), which are essential to maintaining oral health.

A Future in Flux

Looking ahead, the true impact of the PRM changes will only be measurable in hindsight. While the modifications are a testament to DDWA’s commitment to iterative improvement and stakeholder engagement, the sustainability of dental practices hinges on the alignment of reimbursement rates with the dynamic economic landscape. As practitioners and DDWA alike navigate these changes, ongoing dialogue and flexibility will be crucial in ensuring that the PRM evolves in step with the real-world financial demands of dental care.

Conclusion: Caution Meets Optimism

In conclusion, while DDWA’s PRM updates for 2024 mark a significant step towards addressing the economic challenges faced by dental practitioners, there’s a palpable sense of caution. Is a 5% increase sufficient to keep up with wage inflation and the ever-growing overhead costs? Will these changes truly bridge the gap between rural and urban practice economics? And importantly, will the revisions enable practice owners to sustainably compensate their team and ensure profitability?

From our perspective, the increases fall short. Based on our 2023 DAG client survey, hygiene wages increased more than 15% during the last two years, which is roughly a $17k-$20k payroll increase per full-time hygienist. If an average practice is doing $1m in collections and they are only seeing a $5k bump as an inflationary adjustment, it’s clearly falling short of the economic demands of a traditional practice staff model. Time will tell if these changes herald a new era of financial prosperity or if they serve as a precursor to a more comprehensive overhaul that many practitioners believe is necessary. What is clear is that the dental community must remain vigilant, adaptive, and vocal to ensure that their economic needs are met not just in 2024, but in the years that follow.

Author’s note: This article merges two perspectives into a comprehensive narrative, weighing the optimism surrounding DDWA’s PRM changes against the skepticism of whether they go far enough in addressing the real economic pressures of dental practices. It offers a balanced view that acknowledges the effort while calling attention to the reality of the financial challenges that lie ahead. The Dental Accounting Group is a fierce advocate for dental practice owners. We will continue to analyze this reimbursement model in the years to come and voice our perspective to DDWA.

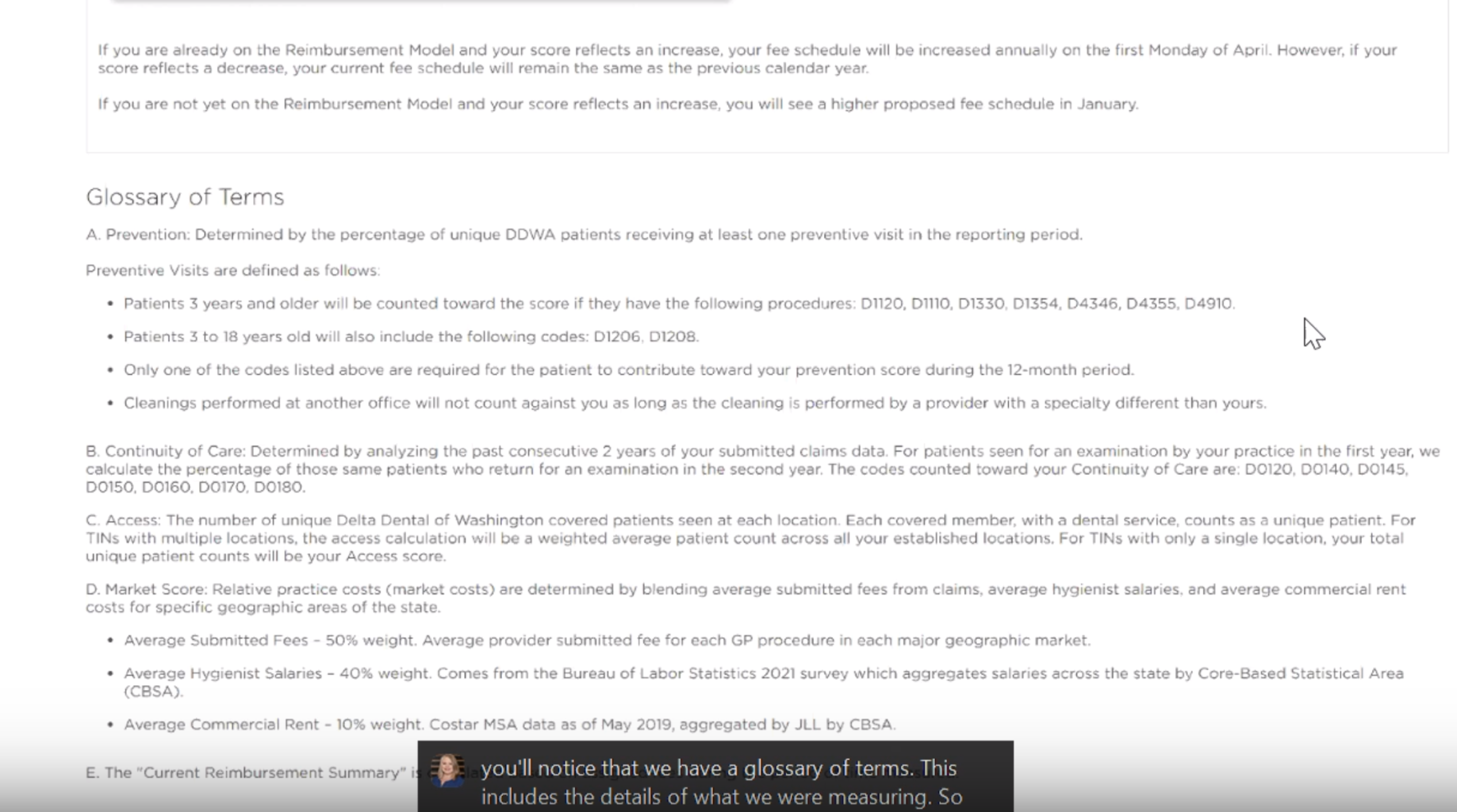

Questions? Refer to your new Delta Dental PRM portal to see the economic impact on your practice. They’ve also added a new glossary of terms:

Additional Reimbursement Resources:

- Explore enhancements to our Reimbursement Dashboard, including the ‘Projected Reimbursement Summary’, where you can view how the 2024 model modifications will impact your practice’s scores.

- Check out our new reimbursement resources and videos when you log into the Provider Portal.

- Read the August 2023 Provider Compensation Committee Announcement for details on our upcoming investments and inflationary increases

- Contact our Reimbursement team with additional questions at Re***********@***********WA.com.

- Not yet on the PRM? Please review the frequently asked questions (FAQs) below for more information.

Credit: Delta Dental of Washington