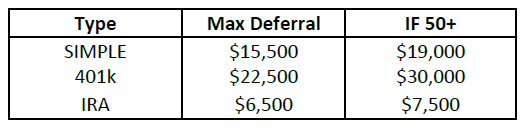

RETIREMENT PLAN LIMITS

The 2023 maximum total contributions to a defined contribution plan (401k/Profit Sharing, SEP) is $66,000 or $73,500 with an over age 50 catch-up contribution.

We encourage our clients to review their retirement plan every few years to be sure they are utilizing the most advantageous plan available.

DEADLINES

October 31, 2022 –

Personal Property and Second Half Real Estate Taxes are due

October 31, 2022 –

Unclaimed Property Reporting deadline – for more information visit http://ucp.dor.wa.gov/app/submit-a-report

December 31, 2022 –

Distribute a notice of eligibility to all eligible employees (for 401k Plans)

YEAR END ITEMS TO BE ON THE LOOK OUT FOR

Reporting of Self-Employed Health Insurance Premiums for S Corporation Shareholders – the total premiums paid must be reported as wages on Form W-2. Be sure to coordinate with your payroll provider. For Dental Accounting Pros clients, we will be in touch early December to be sure you have reported for 2023.

2024 Salary Schedules for S Corporations or Family Members on Payroll – For those whom we provide recommended salary and withholding levels, updated schedules will be sent to you in mid-December. Be sure to watch for this important document and have it established with your payroll company for the first payroll run in 2024. If you would like us to enter this into payroll on your behalf, we request that you specifically let us know that, as we otherwise will not alter wage and tax withholding.

List of Assets Clean-Up – Near the end of the year, we will be sending you a copy of your most recent list of practice assets. Reviewing this and letting us know of any assets that are no longer in service – whether sold, scrapped, broken, obsolete, etc. – is key to making sure we capture all depreciation deductions. If we prepare your annual Personal Property Affidavit for the county, this is also the same schedule that the county uses to assess your personal property taxes.

WORKING INTERVIEWS AND PAYROLL

Many dentists use “working interviews” as a way to vet prospective employees and see how they perform in a clinical setting. Any compensation for such interviews should be done through payroll, the same as with any employee. This includes all payroll taxes and withholding, and the interviewee should be issued a W-2 the following January. During the interview, they are operating under your guidance and supervision, and the IRS and state payroll agencies will no doubt classify them as employees. There is no minimum hours or payment required, and this is true even if you do not end up hiring them.

It requires some extra time up front to obtain a Form W-9 and enter them in your payroll system, but it can save many headaches later should you be audited for payroll compliance or should they be injured while in the working interview.

CHART OF ACCOUNTS UPDATE

We are currently standardizing the chart of accounts in QuickBooks for all clients. The chart of accounts is the listing of codes used to categorize expenses and transactions. By standardizing, we will be able to prepare more comprehensive analyses for you in the future. Many of you will not notice any differences. The biggest change will be where certain items appear on the Profit & Loss statement, such as grouping all staff costs under the same heading, or having all facility-related costs (rent, maintenance, utilities, etc.) appear together. This is merely a formatting issue, but it will allow us (and you) to quickly look at your reports and get a better sense of your overhead and profitability.

Note that some of our clients use 3rd party bookkeepers who may have their own chart of accounts preferences. We will reach out to those we feel could benefit from some changes. Let us know if you have any questions.

POSTING MEALS & ENTERTAINMENT IN QUICKBOOKS

You will notice with the chart of account changes that there are multiple categories for meals and entertainment. As a reminder, we had temporary rules for 2021 and 2022 that allowed for some meals to be fully deducted that would otherwise only be allowed at 50%. Those rules expired at the start of 2023.

With the changes we are making, there will be four categories that meals (and entertainment) could fall under.

• Staff Meeting & Events – things like holiday parties, summer picnics, or occasional team-building type activities, which are 100% deductible. These must be offered to all staff and not be lavish or extravagant.

• Business Meals (50%) – as the heading implies, these are only 50% deductible. This is for meals with vendors, referral sources, or staff where business is conducted during or immediately before or after the meal.

• Business Entertainment (non-deductible) – tickets to sporting events or concerts, or entertainment for non-employees. If an invoice splits the costs of food from the venue rental or other costs, you may deduct the meals portion under the 50% category. But if it is something like a suite at a sporting event that includes food, and the invoice only shows one total price, the entire amount is non-deductible entertainment.

• Owner Draws/Distributions – meals that have no business purpose attached are not deductible and should not even be reported on the Profit & Loss statement. If you pick up a meal while returning from a meeting and eat that meal at your office, unless it meets any of the categories above, it is a non-deductible personal expense.

If you see an expense category that includes both meals and entertainment, that is left over from previous tax rules and should not be used. We can help to deactivate any such accounts. As always, don’t hesitate to ask us if you are not sure how to code an expense.